Table of Contents

A Shift in Google Pay Practices

Google Pay Convenience Fee: Users of Google Pay in India have recently encountered a notable change in the form of a convenience fee of Rs 3 when recharging their mobile phones through the app’s UPI service. This marks a departure from Google Pay’s previous stance of not imposing additional charges for such transactions. The introduction of this convenience fee aligns Google Pay with other payment platforms like Paytm and PhonePe, which have long charged users for similar services. In this article, we will delve into the specifics of this change and its implications.

Uncovering the Convenience Fee

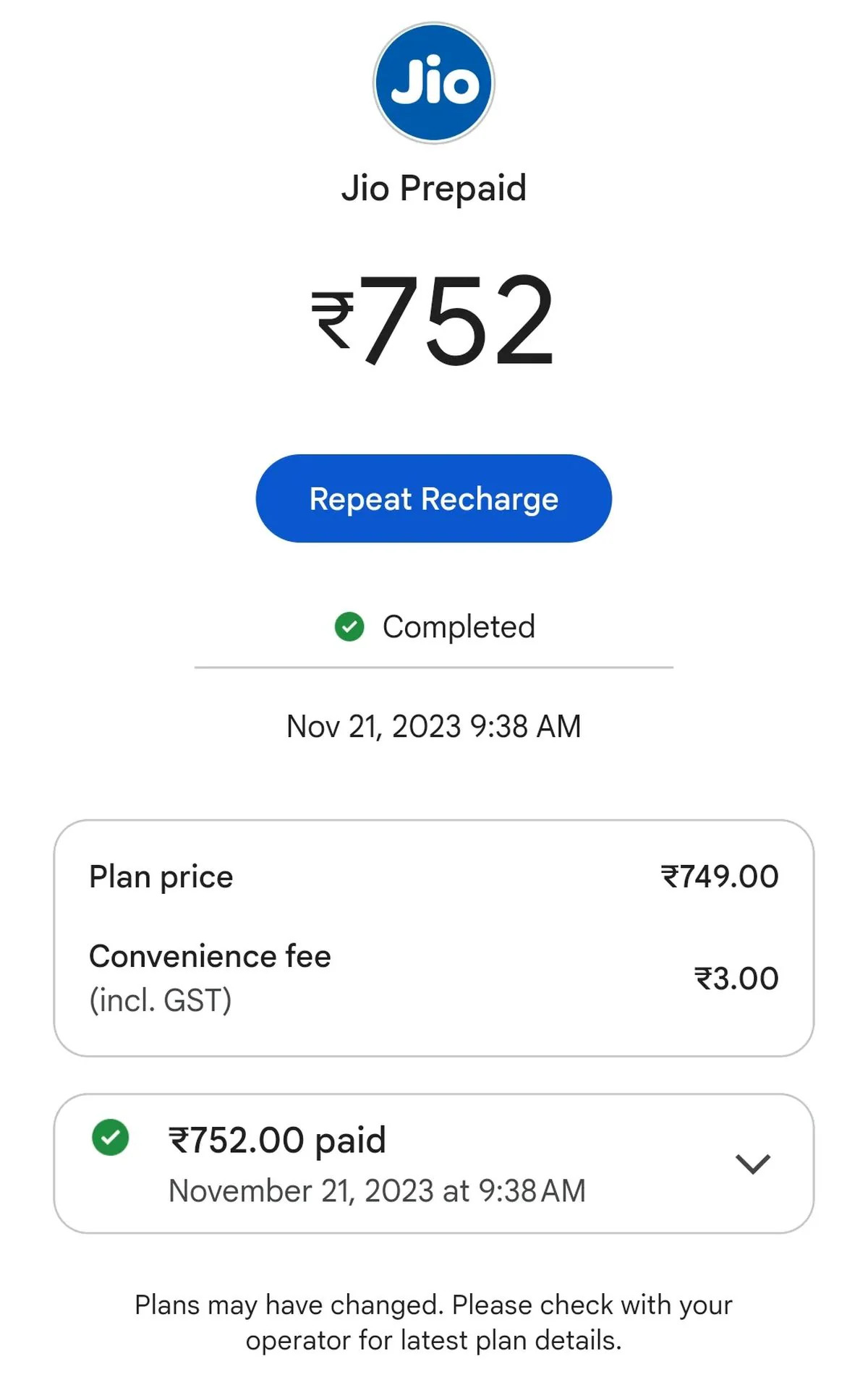

The revelation of this new Google Pay Convenience Fee came to light when a user shared a screenshot online, showcasing a Rs. 3 convenience fee on a Rs. 749 prepaid recharge plan from Jio. It’s crucial to note that this fee applies to both UPI and card transactions, marking a significant shift in Google Pay’s approach to user charges.

Google Pay Convenience Fee Structure: Understanding the Details

Insights provided by tipster Mukul Sharma on Twitter shed light on the specifics of these charges. Recharge plans below Rs. 100 will not incur a convenience fee, while plans ranging from Rs. 100 to Rs. 200 and Rs. 200 to Rs. 300 will have charges of Rs. 2 and Rs. 3, respectively. Transactions exceeding Rs. 300 will face a Rs. 3 convenience fee.

Google’s Silence and Updated Terms of Service

While Google has not made an official announcement regarding these convenience fees, recent updates to the terms of service for Indian users mention the introduction of new charges. According to the updated terms, users will be informed about applicable fees before completing a transaction, emphasizing that these fees are subject to the company’s discretion.

Following in the Footsteps of Competitors

Google Pay’s shift in policy mirrors a broader trend among payment service providers in India. Platforms like Paytm and PhonePe have paved the way, aiming to monetize their services by introducing fees for transactions. This strategic move aligns with similar charges implemented by various online services for tasks such as ordering food or booking movie tickets.

Navigating the Convenience Fee Landscape

Interestingly, purchasing recharge plans via the operator’s website appears to be the sole route to avoid convenience fees on Google Pay. It’s noteworthy that Google Pay is not the first payment service provider to introduce additional fees for transactions; this practice was previously adopted by rivals Paytm and PhonePe.

Conclusion

As Google Pay joins the ranks of platforms charging convenience fees, users are urged to stay informed about these changes. The evolving landscape of payment service providers in India signals a shift towards monetization, aligning with industry trends. In this dynamic environment, understanding the fee structures and exploring alternative avenues becomes crucial for users seeking to navigate these changes seamlessly.

UPI Landscape: PhonePe, Google Pay, and Paytm Dominate Transactions in 2023

The latest data from the National Payments Corporation of India (NPCI) reveals that three major players—PhonePe, Google Pay, and Paytm—continue to dominate the UPI (Unified Payments Interface) landscape. Let’s explore the key statistics from October 2023 and understand how these platforms compare to their positions in the previous year.

- Transaction Volumes:

- PhonePe: In October 2023, PhonePe led the pack, accounting for an impressive 46% of UPI transaction volumes. This is a slight dip from its 47% market share in the same period last year (October 2022).

- Google Pay: Securing the second position, Google Pay represented 36% of UPI transactions in October 2023, compared to 34% in October 2022.

- Paytm: Despite a marginal decrease, Paytm held a significant share, contributing 13% to UPI transaction volumes in October 2023, down from approximately 15% in the previous year.

- Value Transactions:

- PhonePe: Not only did PhonePe dominate in transaction volumes, but it also led in terms of value, commanding a 48% market share in October 2023.

- Google Pay: Google Pay maintained a strong position with a 34% share of UPI value transactions.

- Paytm: Paytm, while experiencing a slight decrease, still held an 11% market share in value transactions as of October 2023.

You can also read:

5 thoughts on “Google Pay Convenience Fee: Google Pay Start Charging Rs 3 on Mobile Recharges!”