Table of Contents

HDFC Bank Addresses Stock Decline

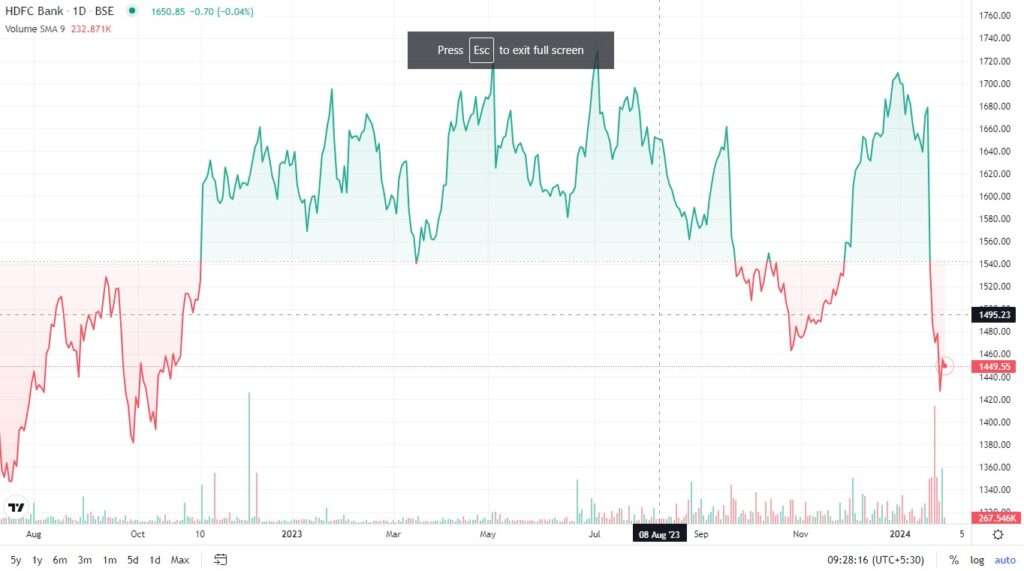

HDFC Bank Stock Price In 2024: HDFC Bank Ltd finds itself caught in a selling spree, attributing the decline in its stock to the Securities and Exchange Board of India’s (SEBI) new disclosure norms for Foreign Portfolio Investors (FPIs). In addition, the bank remains steadfast in its merger with HDFC Ltd, expressing pride in the amalgamation despite recent challenges.

SEBI’s Disclosure Norms and Market Volatility

The bank contends that SEBI’s understanding of the beneficial ownership disclosure rules needs to be explicitly communicated in writing. These rules are slated to take effect from February 1, causing considerable turbulence in the equity market. The benchmark Sensex witnessed a sharp drop of over 1,000 points, reflecting the nervous sentiments following the regulatory changes.

You can also read: Vande Bharat Express Expansion: 60 New Vande Bharat Trains In 2024!

Foreign Portfolio Investors’ Impact

Foreign Portfolio Investors (FPIs) are reported to be offloading HDFC Bank shares in recent trading sessions. Over the last four trading days, FPIs have divested shares worth over Rs 27,000 crore, reversing the trend from earlier in the year when significant investments led to record market highs.

HDFC Bank Merger With HDFC Ltd

Contrary to market concerns, the report emphasizes that HDFC Bank is not apologetic about its merger with parent company Housing Development Finance Corp (HDFC). The bank expresses pride in the amalgamation, citing expectations of rising margins in a “secular fashion.” Notably, HDFC Bank refrains from providing quarter-to-quarter guidance.

You can also read: CLARIFICATION ON 2024 LOK SABHA ELECTION DATE SPARKS SOCIAL MEDIA BUZZ!

HDFC Bank Financial Performance and Margins

While HDFC Bank’s standalone net profit for the third fiscal quarter exceeded analyst estimates, its core net interest margin (NIM) on total assets experienced a decline from 3.65% to 3.4% compared to the previous quarter. This is a notable change from margins exceeding 4% before the merger with HDFC in July of the previous year.

HDFC Bank Stock Price Today

HDFC Bank Stock Price In 2024: According to brokerage Jefferies, the margin decline is a “key miss,” and the key to restoring NIMs lies in higher retail deposit mobilization and lending. Presently, HDFC Bank’s stock is trading 1.98% higher at Rs 1,455.85, demonstrating a complex performance with a -14.82% change for the year and a -5.31% change in the last five days.

You can also read: UPCOMING IPO IN JANUARY 2024: EXCITING IPO LAUNCHES THIS WEEK!

HDFC Bank Company Profile

The company, in its last quarter, posted a net profit of 17,257.87 Crores. HDFC Bank’s peers include ICICI Bank and State Bank of India. Notably, HDFC Bank maintains a 25.52% promoter holding and 100.00% public holding. Mutual Fund holding in HDFC Bank increased to 9.07% as of December 31, 2023, while Foreign Institutional Investor (FII) holding rose to 52.29% during the same period.

HDFC Bank Stock Performance

Conclusion

As HDFC Bank navigates through market uncertainties and adapts to SEBI’s new norms, the institution’s resilience and strategic outlook will play a crucial role in shaping its future trajectory. Investors, analysts, and stakeholders keenly observe the unfolding developments in this dynamic financial landscape.

You can also read: Advancements In Mumbai-Ahmedabad Bullet Train Project: Thane Rolling Stock Depot Contract Awarded By NHSRCL!

1 thought on “HDFC Bank Stock Price In 2024: HDFC Bank Addresses Stock Decline Amid SEBI’s New FPI Disclosure Norms!”